nevada estate and inheritance tax

Create Your Legal Will in 20 Mins. As well as how to collect life insurance pay on death accounts and survivors benefits and.

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

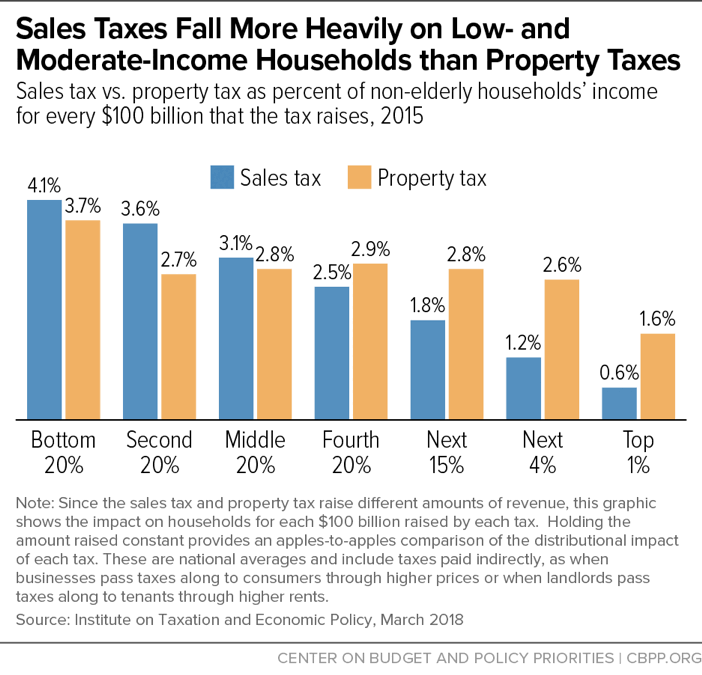

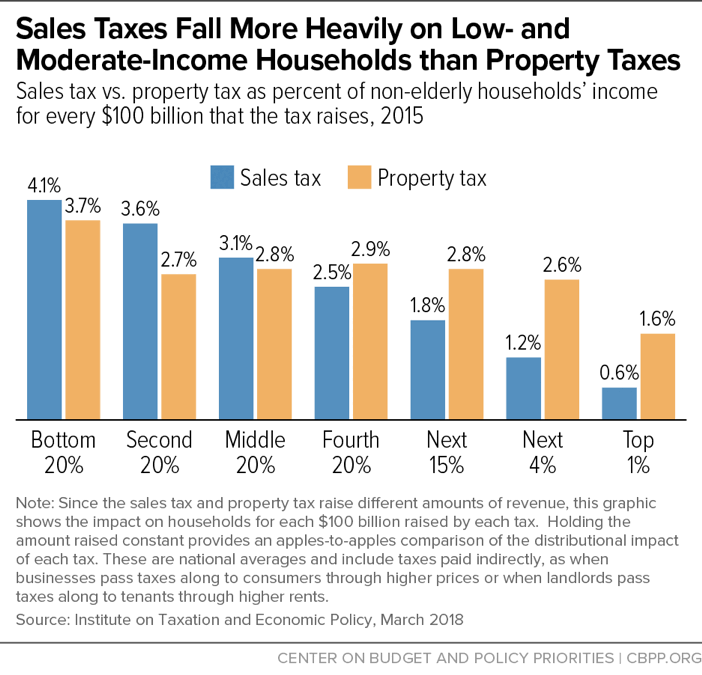

. Under Nevada probate law probate is the process of verifying the proper transfers of property after a persons death. Each state has its own tax laws which govern taxation. Sales tax is one area where Nevada could do better.

NRS 375A025 Federal credit defined. Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax.

This means that you do not need to. However an estate in Nevada is still subject to federal inheritance tax. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

2011 in respect to a. Fortunately Nevada does not. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax.

Best Tool to Create Edit Share PDFs. Dont leave your 500K legacy to the government. Nevada also does not have a local estate.

Ad 3995 100 Money Back Guarantee. Ad Get free estate planning strategies. Under Nevada taxation laws there is no provision for inheritance and estate taxes.

Inheritance tax is only paid at. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Ad Vast Library of Fillable Legal Documents.

Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Find state-specific templates and documents on US Legal Forms the biggest online library of fillable legal templates. The state imposes a 685 tax and counties may tack on up to. Info about Nevada probate courts Nevada estate taxes Nevada death tax.

The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs. Click the nifty map below to find the current rates. In 2021 the first 117mil per individual is exempt at the.

There are no estate or inheritance taxes in the state either. Federal credit means the maximum amount of the credit against the federal estate tax for state death taxes allowed by 26 USC. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Sometimes it can be both. NV does not have state inheritance tax. Here are the answers to five common Nevada inheritance tax questions 775 823-9455.

If the total amount of the deceased persons assets exceeds. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Where the taxes are paid at the state level or the federal government level For any tax find out if its paid at the state or federal level.

1 PDF Editor E-sign Platform Data Collection Form Builder Solution in a Single App. But Nevada does have a relatively high sales tax a state rate is around 7 but.

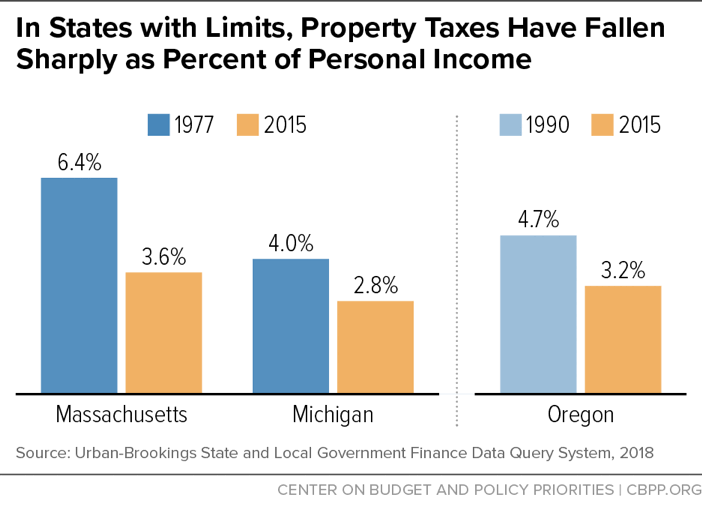

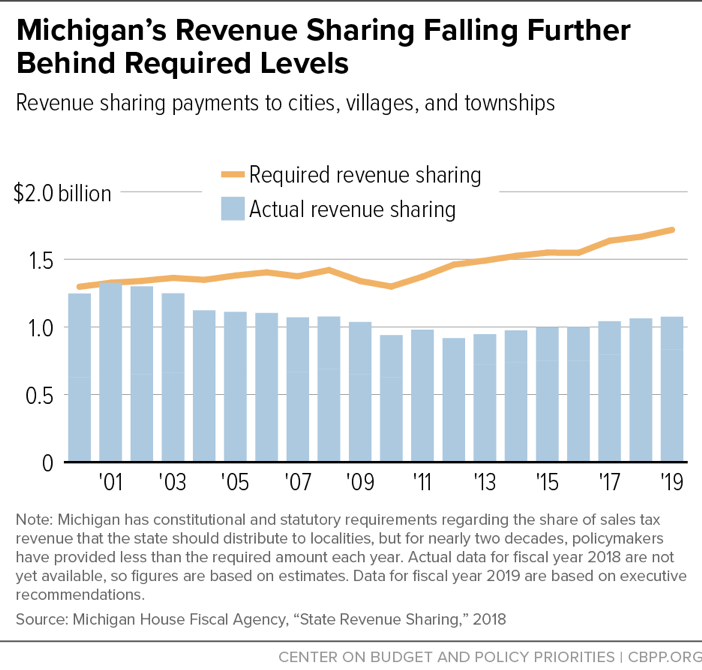

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Transaction Lawyer For Businesses And Entrepreneurs Family Law Attorney Divorce Lawyers Estate Lawyer

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Probate Deadlines Reed Mansfield Attorneys

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Where Not To Die In 2022 The Greediest Death Tax States

Will I Receive A Step Up In Basis For This Inherited Property Isc Financial Advisors

22 Best Paradise Tax Services Expertise Com

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

Where Not To Die In 2022 The Greediest Death Tax States

Amp Pinterest In Action Will And Testament Last Will And Testament Doctors Note Template

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Inheritance Tax Here S Who Pays And In Which States Bankrate

Divorce Laws In Utah Free Attorney Consultation Divorce Law Family Law Attorney Divorce Lawyers

Inheritance Tax Here S Who Pays And In Which States Bankrate

Nevada State Seal Zazzle Nevada Nevada State Nevada Usa

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities